U.S. row crop producers have been involved in one of the longest bear markets in history, dating back to perhaps the 1980s. Beginning in 2013, this bear market has been long-lasting and severe with many U.S. operations, losing equity that was built with good crops and excellent marketing opportunities. Since 2012, the world supply situation caught up with aggressive demand growth and grain balance sheets, operating with large surpluses. This has been devastating for prices and challenging for producers who make a living by growing corn and soybeans. Farmers Coop Society offers a solution to help maximize your profit potentials—a written individual grain marketing plan.

THE PLAN

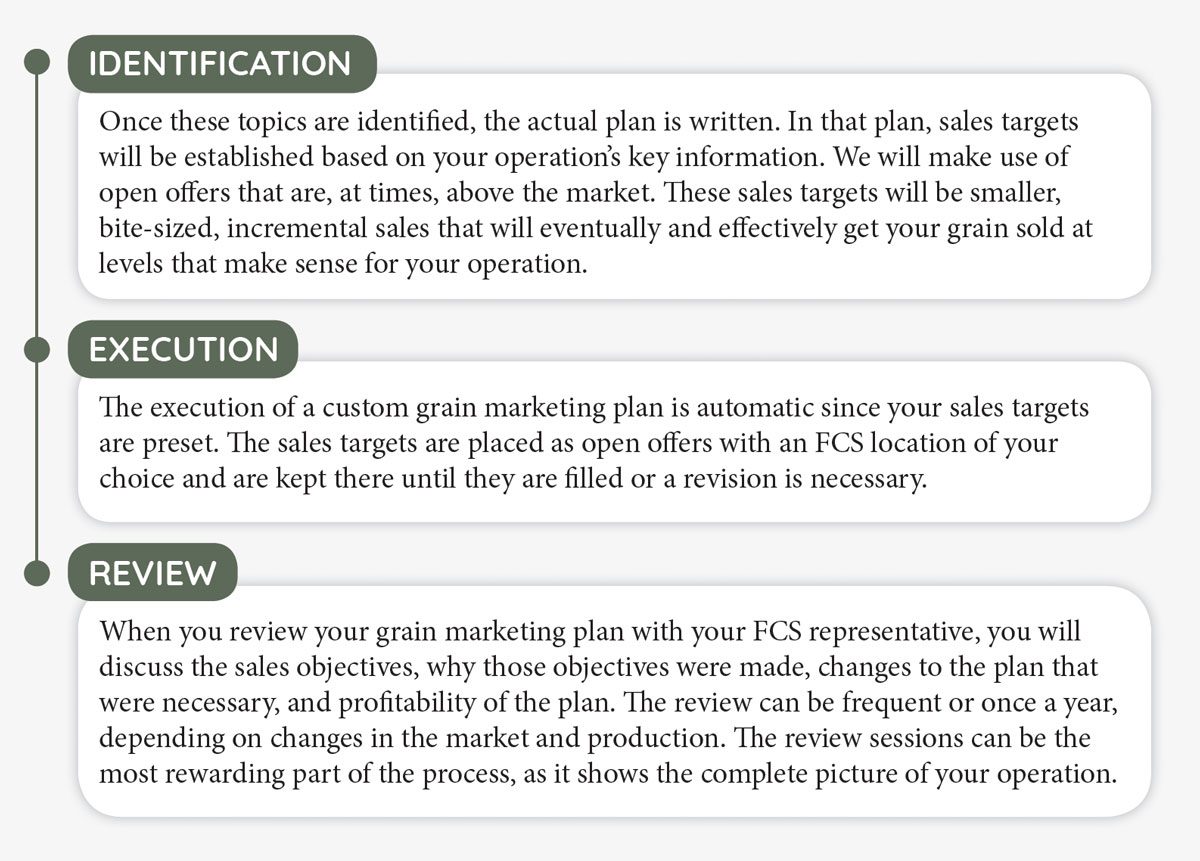

A well-developed grain marketing plan has three parts: identification of key operation information to write the plan, execution of the plan, and reviewing the plan as markets and conditions change.. Identifying key operation information includes the fine details and is the most thought-provoking part of the process. This includes total estimated production, storage capacity, cash-flow estimates, key delivery point identifications, cost of production, etc.

THE BENEFITS

A strategic written grain marketing plan takes the emotion out of grain marketing. Have you ever experienced a change in market sentiment overnight where the trade became overly bullish, making new lows just before you are harvesting...and you were waiting to sell your grain because the experts said the market was going higher? From my experience, all growers have experienced this a time or two. Begin by looking at the bigger picture today. If a plan was developed and executed, your crop would have been marketed well before the bottom fell out.

Start by thinking forward and marketing your grain ahead. Farmers Coop Society is here to help you develop a plan that works for you and your operation. In the past few years, we have seen the corn and soybean structure have a wide carry environment. The only way to capture that carry is to forward sell it. Today, new crop futures are 20–30 cents higher than the nearby month. If the U.S. has another normal-to-good crop, new crop futures will most likely erode to where the nearby market is, failing to earn its carry.

If you want to start thinking forward and make the most out of your gain profit potential, please call me at 712-722-2671. Our grain team is more than happy to sit down and talk about your operation, figure out what makes sense for you, and customize a plan that is right for you.

Written by: Matt McCord